Still interested in Holmen's goals and reports, please download the latest annual report below

Sustainable business goals follow-up

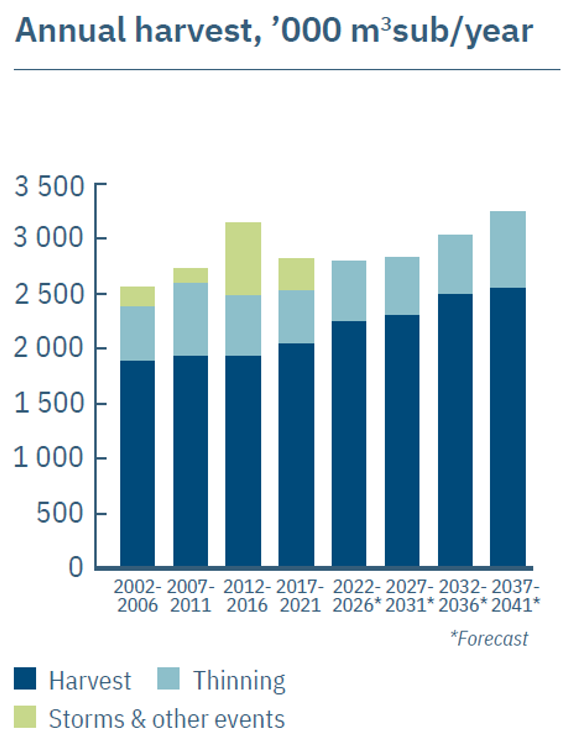

Forest

The forest is sustainably managed to provide a good annual return and stable value growth. Growth and harvests will increase over time.

In 2020, a new harvesting plan was drawn up for 2021–2030, under which the annual harvest will increase by 0.1 million m3 compared with 2016–2020, while keeping the amount of thinning unchanged.

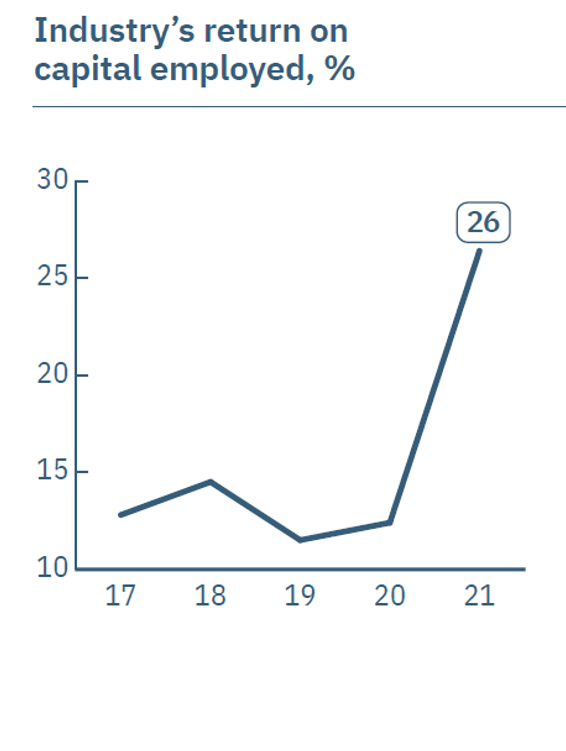

Industry

Industry’s return on capital employed, %

The industrial operations are run with a focus on long-term profitability. The target is for a sustained return of over 10 per cent on capital employed.

In 2021, the return for the industrial side of the business reached 26 per cent, driven by excellent profitability in Wood Products.

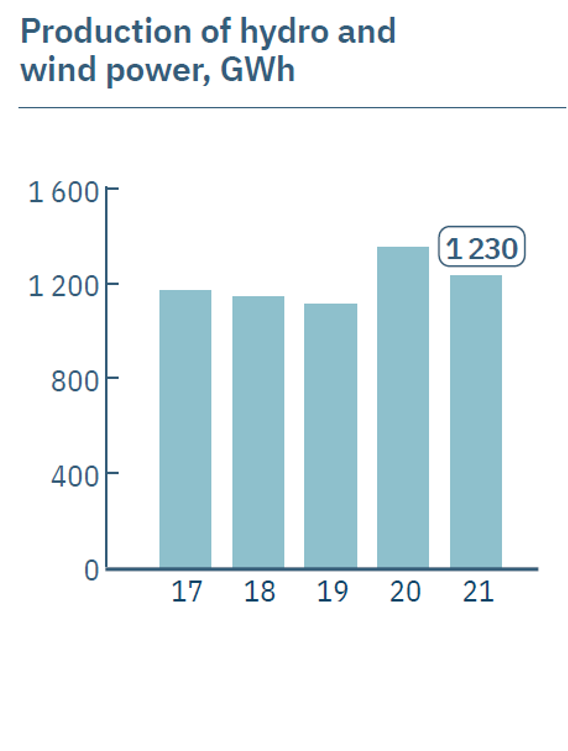

Renewable energy

The production of renewable energy will increase by complementing our existing hydro power with wind power on our own land.

The level of hydro and wind power production was normal, amounting to a little over 1.2 TWh. 2022 will see the wind farm in Blåbergsliden become fully operational, which is expected to boost the Group’s annual production of renewable energy by a little over 0.4 TWh.

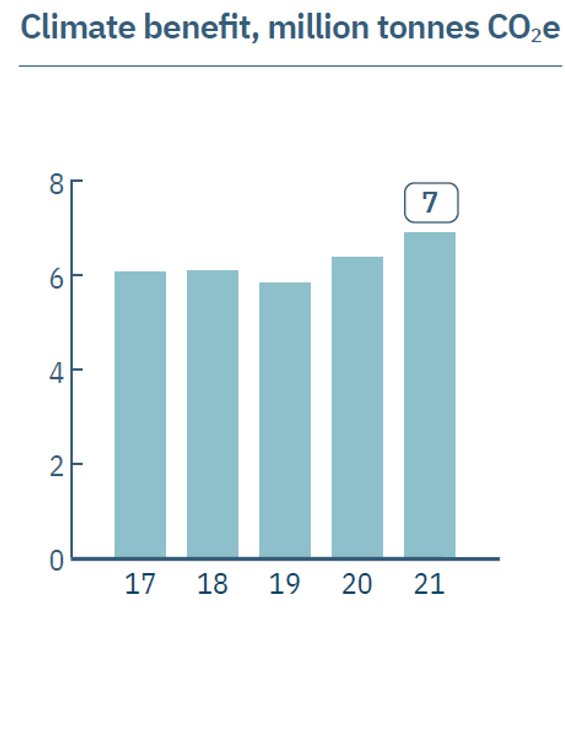

Climate benefit

We will increase our benefit to the climate through higher growth in our forest and higher sales of renewable products that store carbon dioxide and replace fossilbased alternatives, while also reducing the fossil emissions along our value chain.

In 2021, Holmen’s operations helped to generate a climate benefit of almost 7 million tonnes of CO2e, with positive contributions from all the business areas.

More information regarding Holmens contribution to the climate.

Capital structure

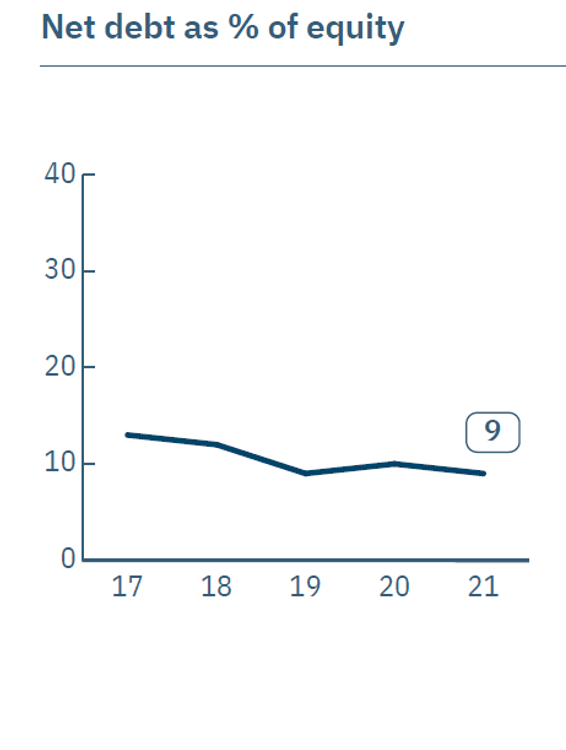

Our financial position is to be strong in order to secure room for manoeuvre when making long-term commercial decisions. Net financial debt will not exceed 25 per cent of equity.

At year end, the financial position remained strong, with a debt/equity ratio of 9 per cent.

Dividend

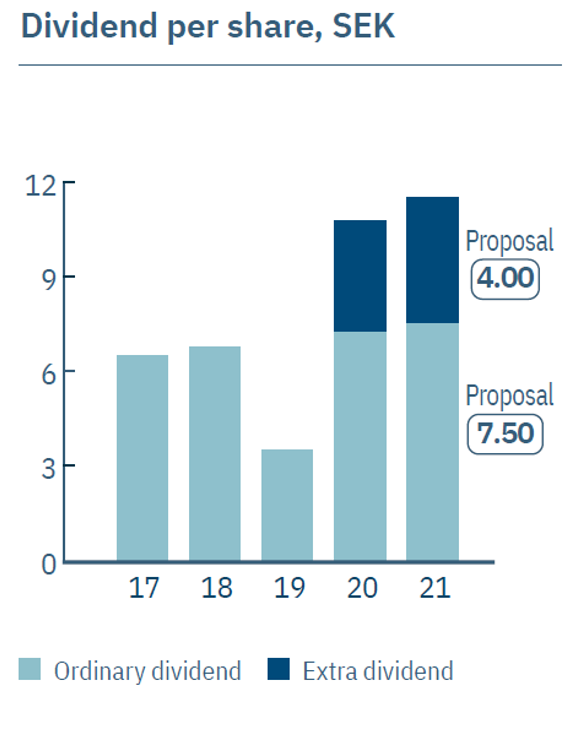

Holmen will generate a good annual dividend for shareholders. The level is determined by the Group’s profitability, investment plans and financial situation. The dividend is supplemented with share buy-backs where this is judged to create long-term value for shareholders.

The Board proposes that the 2022 AGM approve a dividend of SEK 7.50 per share and an extra dividend of SEK 4.00 per share.