“Direct mail is collected from the same mailboxes during the same month yearly."

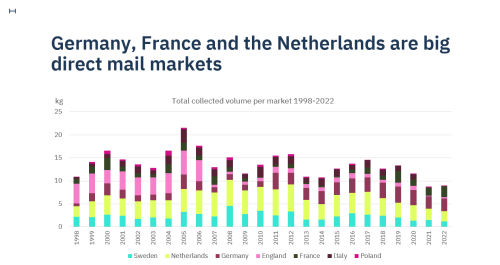

For 24 years now – since 1998 – the Sales & Marketing Intelligence team (SMI) within Holmen Paper has conducted a direct mail study aiming to follow up on how direct mail volumes change over time. The study is repeated with the same parameters every year, adding insights to all the official paper production and sales statistics that Holmen follows from organisations such as CEPI, PPPC and Eurograph.

Discerning patterns and trends

"The aim of the study is to discern patterns and trends by examining the actual material that ends up in physical mailboxes", says Ebba Alvestrand, who was part of the investigating team in 2021 and 2022.

"The aim of the study is to discern patterns and trends by examining the actual material that ends up in physical mailboxes", says Ebba Alvestrand, who was part of the investigating team in 2021 and 2022.

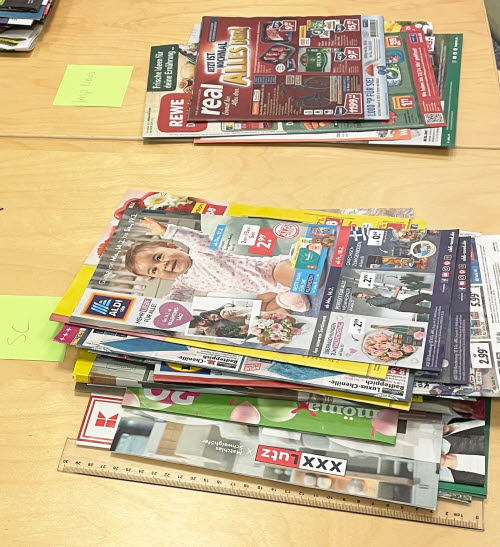

"Direct mail is collected from the same mailboxes during the same month yearly in different countries", she explains. Countries included are Germany, France, the Netherlands, Sweden, Italy, England and Poland. The material is sorted and weighed, and then compiled in comparisons for volume-per-market and quality.

"For us, it's very interesting to see which paper qualities are used in different markets, and whether some qualities grow or decrease for different types of usage", Ebba Alvestrand points out.

Assessment of paper quality

Several different steps are included in the assessment of paper quality. The team feels the paper and compares it with paper that they know is of a certain quality. This is done using techniques such as scraping the paper with a tool to see if it is coated or not, and tearing the paper to look at the fibres through a magnifying glass – the fibre length reveals whether it is a mechanical or woodfree paper.

In the most recent study, conducted in February 2022, the following qualities were found, stated from the most used to the least used: super-calendered paper (SC), improved newsprint, standard newsprint, light-weight and medium-weight coated (LWC and MWC), coated woodfree (CWF), paperboard (PB), and uncoated woodfree (UWF).

SC paper stood for 50% of the collected volume in 2022.

There was a large share of uncoated mechanical grades used, especially in the big European direct mail markets Germany, France and the Netherlands. And the super-calendered papers (SC) have grown in use compared to the other paper grades.

"SC paper stood for 50% of the collected volume in 2022, measured in weight", Ebba Alvestrand says. "This is noteworthy, since SC is one of the lightest paper grades."

Already in 2017, SC papers grew to become the most used paper grade in the study, passing improved newsprint. Since then, SC has kept the top position also during the years of Covid-19 restrictions.

Negative trend but small growth 2022

While direct mail has proven to be cyclical, the trend is negative. Since 2000, collected volume has decreased by 41%. This corresponds to an average decrease of 2.4% per year. But a small increase in volume could be seen in the 2022 SMI direct mail study. Especially the volume in France has increased, despite the fact that there are areas in France where consumers actively have to say "yes" to receive printed advertising in their homes.

The direct mail volume in France has actually grown by as much as 36% in 2022 year-over-year. In total, Germany, France and the Netherlands are the biggest direct mail markets, and when comparing the development of the collected volumes per post box, these markets now show growth again in 2022 after a decline since 2019.

Better, long-lasting effect

"Direct mail has in fact recovered much faster than other printed segments since the pandemic", says Anders Gyllenhammar, VP sales for graphical papers at Holmen Paper. "We can see that retail and direct mail experience an upswing during tough times. Consumers spend less money, and retailers spend more on advertising to get people to buy their products."

"Research also shows that printed advertising has a better, long-lasting effect in keeping a brand top-of-mind than campaigns that are solely digital," he remarks. "There is a point in combining digital and print to increase your market share and get the best bang for your buck."

AdWeek also reports that the rise of direct mail may seem as a surprise, but isn't a surprise at all. They refer to digital price increases and media fatigue as reasons for a new growing interest in print advertising. For example Meta's 2021 end-of-year summary shows a price increase of 24% per ad, while only delivering a 10% increase in impressions. "Performance marketers are catching on to the fact that digital ads are eroding in value," according to AdWeek.

It may be worth noting that when the development of digital and print markets are compared, the measurement is often made in spent money. But more money spent does not necessarily reflect future growth.

"We still find it interesting to collect, compare and measure the weight of the advertising material that is sent out to people's physical mailboxes, because this gives us an insight that official statistics cannot show," concludes Ebba Alvestrand. "That which matters is how the potential consumer sees the advertising and what he or she likes about it. The volume and the paper choices are important factors influencing how the ads are perceived, and thereby also the results of direct mail marketing."

Article by: Jonna Dagliden Hunt and Linda Åslund

Images by: Laura Stanley and Ebba Alvestrand